What Is a Charge Card? A credit card works similar to credit cards, but instead of allowing to carry the balance from month each month, you must pay off the balance each month. It’s a means to make payments without together cash up front, however you must be cautious to limit your spending to the amount you are able to pay every month.

Many people mistakenly use the words “charge card” and “credit card” in the belief that they are the similar thing. Although the two types of cards share some similarities however they’re not the exact identical. They’re similar to credit cards since they are able to be used to purchase everyday items. Instead of paying the minimum balance every month, customers are required to pay their entire amount in the full amount.

If you’re thinking about applying for a credit card, you must be aware of how it functions and the advantages of using this kind of card. Read on to find out more.

What Is a Charge Card and How Does It Work?

Charge cards are a form of credit card that it is possible to make online as well as in-store purchases. Contrary to credit cards credit cards require cardholders pay their entire balance by the time of the billing.

A lot of charge cards offer different rewards and perks, including reward miles, cash back. Most of the time you need to have good or excellent credit score to be eligible for a credit card.

Credit Cards are different from. Credit Cards

Many people believe that the two are one issue, the truth is that there’s a few distinct differences between them.

Minimum Payment

Cardholders with credit cards are required to pay at minimum the minimum amount each billing cycle. It could be a fixed amount or dependent on a percentage of the total amount due. This feature lets cardholders purchase items now and then pay them off over a number of months. Inability to pay minimum monthly payments every month can result in penalties for late payments and other penalties.

In contrast, credit cards have no minimum amount of balance. Instead, cardholders are required to pay the entire balance by the conclusion of the billing cycle. In the event of non-payment, it could result in additional costs and the card issuer might cancel or close the account.

Certain charge cards provide different payment options for cardholders. For instance, American Express gives cardholders the feature to make use of the pay Over Time feature, which lets them pay the amount of purchases they have made within a specified time.

Spending Limits

If you make an application for a credit or debit card, you’ll be given a specific spending limit that you aren’t allowed to overspend without risking penalty charges. Credit cards, on the other hand, do not have a established spending limit. Instead, the approval process for purchases depends on your personal earnings, payment history and credit score.

APR Rates

APR rates are determined by the score and credit record. score. If you own credit cards, your APR is revealed at the time of approval and appears on your monthly statement. The interest, calculated based on your APR, will be charged on any balance that is not paid at the close each cycle.

The interest rates aren’t applicable to credit cards. Because you’re obliged to pay your amount in full every month, there won’t be an unpaid balance that could generate interest. If you fail to pay the balance it could result in charges for late payment and penalties.

Pros and Cons of Charge Cards

Before applying for a credit card, you must know the pros and cons associated with this type of card.

Pros

There are numerous benefits to using a charge card like:

- The absence of a spending limit will permit you to make bigger purchases without worry about going over the limit.

- Since you’ll have to pay the balance each month, you don’t have to fear about excessive APRs.

- A lot of charge cards offer significant rewards, benefits, and other perks.

Cons

While the benefits are fantastic however, you must think about the negatives of using a credit card, which include:

- Credit cards typically come with huge annual charges. Make sure to be aware of the fine print prior to making a decision to apply for a credit card.

- Typically, you need to have excellent or good credit score to be eligible for the credit card.

- You must be able to cover the entire charge card balance every month or risk paying additional penalties and late fees.

How Do Charge Cards Impact Your Credit Score?

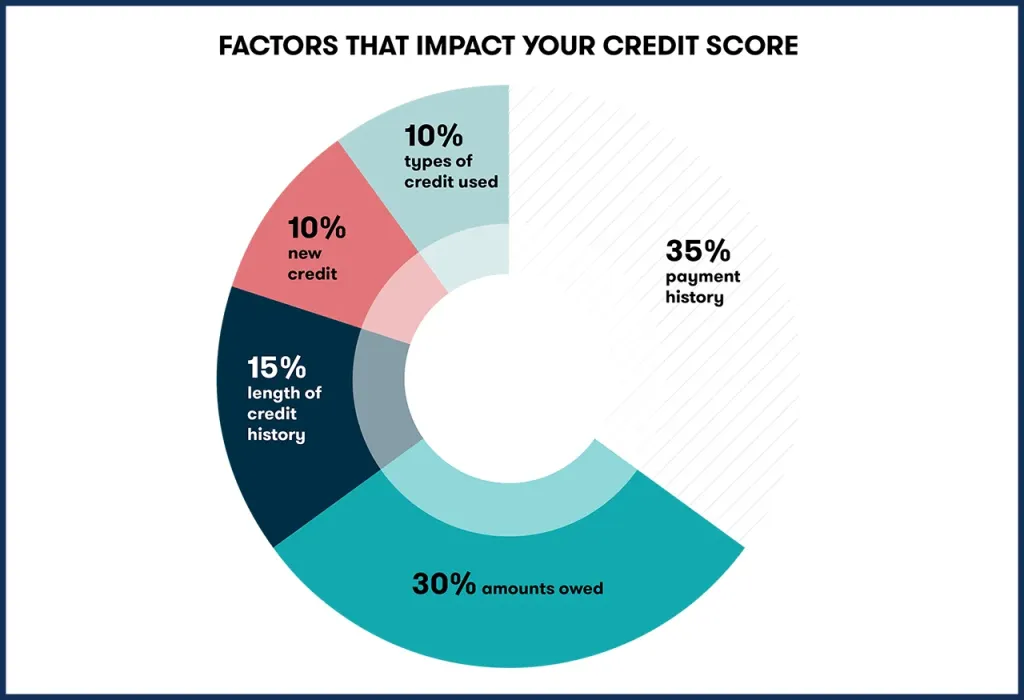

Another thing to think about when you are considering the credit card you want is the impact it has on you credit rating. Credit card companies typically make sure that all transactions are reported to 3 major credit bureaus: TransUnion, Experian, and Equifax. Because your credit history can account for 35% or more of your credit score (FICO), paying on time every month’s payments could significantly impact your credit score.

If it’s about how much you use of credit which can account for 30 percent or more of your FICO credit score having a credit card won’t affect your score. Since there’s no spending cap in most credit scoring models, they do not take into account charge cards in making calculations for credit utilization.

However the charge card does not provide you with credit that you can make use of to increase you credit utilization. However you can make huge purchase with your charge card without having to concers about negatively impacting the ratio.

When to Get a Charge Card

You may have a restricted selection of credit cards. However, you can find a variety of choices like American Express American Express Platinum Card(r) offered by American Express and the American Express(r) Gold Card. Make sure you compare your options and check the fine print before making any application for credit.

You might need excellent or even outstanding credit. If you don’t think your credit is suitable currently it is possible to do some things towards rise it. When your credit score is in that “good” range, you may consider applying for a credit card.

Summary

Charge cards operate similarly to credit cards but require cardholders to pay off the balance in full each month, without the option to carry a balance. They offer rewards and perks and typically require a good or excellent credit score for eligibility. Unlike credit cards, charge cards have no preset spending limits, no minimum payments, and do not accrue interest. However, they may come with high annual fees and require responsible financial management to avoid penalties.

Thanks for Reading this article for more information please visit. www.infonust.com

FAQs

How do charge cards differ from credit cards?

Charge cards require payment of the full balance each month, have no preset spending limits, and do not accrue interest, unlike credit cards.

What are some pros of using charge cards?

Pros include the absence of spending limits, no worry about high APRs, and potential for significant rewards and perks.

What are some cons of using charge cards?

Cons include high annual fees, the need for a good or excellent credit score, and the requirement to pay the full balance monthly to avoid penalties.

How do charge cards impact credit scores?

Charge card transactions are reported to credit bureaus, and timely payments can positively impact credit scores. However, charge cards do not affect credit utilization ratios as they have no preset spending limits.

When should one consider getting a charge card?

Consider getting a charge card if you can manage paying the full balance each month, have a good or excellent credit score, and are willing to pay potential annual fees for the benefits offered.